· Education oriented

· Available for local and central governments

· Solutions for all

Customised Map Layers to meet design demands

Customised GIS solutions for web, mobile and desktop applications

Spatial Database Development

Customised GIS Applications

Project Planning and Quality Control

About Our Company

Henson Geodata Technologies Ltd

Henson Geodata Technologies Ltd (HGT) is a privately registered Limited liability company in Ghana. HGT is a GIS (Geographic Information Service) company developing location – based software.

Software Development

GIS Consultancy

- Systems Design, and Implementation

- Data Collection, Capturing and Conversion

- Spatial Database Development

Perfect solutions that business demands

Providing excellent technology solutions

We eagerly implement fresh IT advances.

What We’re Offering

Dealing in Professional IT Services

We offer a full-cycle software development services that meet varied business requirements from IT strategy consulting to the end-to-end development of scalable solutions.

Software Development

Our user friendly software is developed with cutting edge tools and technologies at modern standards by expert software developers and professionals.

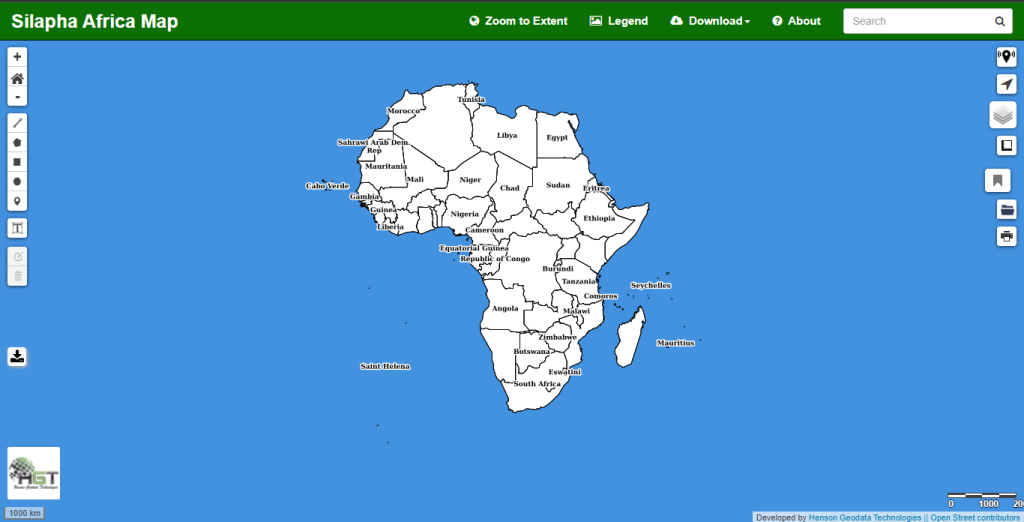

Map Services

Our topographic basemap of Africa serves as a foundation providing users with a geographical and visual context of an area.

GIS Consultancy

By combining your business data with geospatial layers, we can perform an integral analysis to make informed decisions to support projects.

We’re Ready For You!

- IT solutions are created by top experts

- Receive consultation for your IT solutions

- Support 24/7 for partners during the process.

Silapha Map